Reading the Market Before You Walk Into the Dealership

Smart negotiation starts with understanding the market. Just like any other major purchase, timing and market dynamics play a crucial role in your car lease price. Knowing when dealers are most eager to close a deal can potentially save you thousands. This involves understanding how broader economic factors and industry trends influence your negotiating position.

Seasonal trends can create opportunities. Dealers often have sales quotas to meet at the end of the month, quarter, or year. This can motivate them to offer more appealing lease terms to move inventory. Certain models might also be less in-demand during specific times of the year, giving you more bargaining power.

Understanding Market Trends

Negotiating a car lease requires awareness of current market trends. For instance, as we head into the first half of 2025, auto lease returns are projected to drop significantly. This decline is estimated to be around 41% compared to the same period in 2024, potentially removing nearly 1 million vehicles from the industry. Understanding these trends can strengthen your negotiating position, as dealers might be more willing to offer favorable deals to compensate for the decrease in lease returns.

Additionally, the premium market is anticipated to see a 46% reduction in lease returns, while mainstream segments will likely experience a 39% decline. Knowing that major brands will experience a wide range of declines, from 11% to 81%, can provide you with valuable leverage during negotiations. Explore this topic further here. This knowledge enables you to anticipate dealer motivations and adjust your negotiation strategy accordingly.

Researching Local Market Conditions

Beyond national trends, local market conditions also heavily influence your negotiating power. Inventory levels, local competition, and even regional economic conditions can all affect lease prices. Therefore, researching the specific market where you’re buying is essential for getting the best deal.

Checking inventory levels at multiple dealerships in your area is an effective tactic. High inventory can suggest a dealer’s willingness to negotiate. Conversely, low inventory for popular models could mean less flexibility on pricing. Understanding the interplay of supply and demand is crucial in this situation.

By considering both national and local market dynamics, you gain the insights necessary to negotiate effectively. This preparation empowers you to walk into the dealership with confidence, knowing what to expect and how to secure the most favorable lease terms possible. This understanding forms the foundation for a successful negotiation.

Mastering Residual Values for Maximum Leverage

Understanding current market conditions is important. But truly mastering residual value is the key to a successful lease negotiation. This value, which represents your car’s projected worth at the end of the lease, significantly impacts your monthly payments and any future buyout options. A higher residual value translates directly to lower monthly payments.

Why Residual Value Matters More Than Monthly Payments

It’s easy to get fixated on the monthly payment. However, the residual value is the real foundation of your lease agreement. It not only determines your monthly payments, but also the price you’ll pay if you decide to buy the car after the lease ends. A car with a high residual value will likely have lower monthly payments and a correspondingly higher buyout price.

Negotiating a lease involves several key factors. Understanding residual value (RV) is crucial. Inflation has significantly impacted vehicle RVs, making lease buyouts a more attractive option for many. Lease End data shows that despite the high price of new cars, used car values remain strong, influencing lease-end decisions. This market dynamic can help you negotiate a better lease, especially if you’re considering a buyout. Even companies like Tesla have reintroduced lease buyout options, highlighting this growing trend. Learn more about these trends here.

Identifying Vehicles With Strong Resale Projections

Some vehicle categories consistently hold their value better than others. SUVs and trucks, for instance, tend to have higher residual values than sedans due to strong demand. Recognizing these trends can give you a distinct advantage during lease negotiations. Researching specific models within these categories can further refine your vehicle selection.

How Inflation Affects Residual Values

Current inflation trends have a direct impact on residual values. As used car prices rise, so do residual values. This creates both opportunities and challenges. Higher residual values can result in lower monthly payments. However, they also lead to increased lease buyout costs.

Lease Buyout Opportunities and Residual Value Forecasts

Carefully evaluating potential lease buyout opportunities is essential. By understanding how residual values are forecast, you can better anticipate whether a buyout will be a good financial decision. This involves analyzing market trends and projecting future vehicle values. If the projected market value is significantly higher than your lease’s residual value, you’re in a strong negotiating position, potentially allowing you to purchase the vehicle below market value. This is particularly relevant in today’s market where used car values remain elevated.

Understanding and leveraging residual value is a crucial skill for successful car lease negotiations. Focusing on this key element can help you secure the best possible terms and minimize your overall leasing costs. This knowledge empowers you to approach negotiations confidently and achieve your desired outcome. By combining market awareness with a deep understanding of residual value, you’re setting yourself up for a smart and advantageous lease deal.

Why Current Market Conditions Favor Smart Leasers

Building on the significance of residual value, the current car market offers unique advantages for those considering a lease. Savvy negotiators can use several factors to their benefit, including fluctuating interest rates, manufacturer incentives, and the speed of inventory recovery. Understanding these market signals and how to use them during negotiations is key to maximizing your savings.

Interest Rates and Incentives: Finding the Right Balance

Interest rates have a major impact on the total cost of a lease. Higher rates typically mean higher monthly payments. However, in today’s market, high interest rates can actually benefit leasers.

High rates often discourage car purchases, leading manufacturers to offer more appealing lease incentives to boost demand. These incentives can counter the effect of the higher interest rates, making leasing more attractive.

For example, a manufacturer might offer lower money factors, which are essentially interest rates expressed as a fraction. They might also offer cash rebates that lower the capitalized cost of the vehicle. These incentives can significantly reduce your total lease cost.

Inventory Recovery and Manufacturer Eagerness

The rate of inventory recovery also plays a role in lease negotiations. A slow recovery often signals sustained high demand, giving manufacturers a reason to keep lease deals attractive to move existing inventory. This can empower you to negotiate better terms, such as lower monthly payments or a smaller acquisition fee.

Manufacturers are also keen to maintain market share, especially during times of economic uncertainty. This can lead to better deals for informed leasers.

Furthermore, the decision to lease is heavily influenced by the current market. The combination of factors like interest rates and incentives can tip the scales toward leasing. With higher interest rates and fewer purchase incentives, leasing often provides better value. Learn more about these factors here.

For instance, as new car inventory slowly recovers, leasing provides a more affordable way to drive a new vehicle. This trend is expected to continue, with the global auto leasing market projected to reach roughly USD 650 billion by 2032, up from about USD 350 billion in 2023.

Comparing the True Cost: Leasing vs. Buying

Understanding the real cost difference between leasing and buying is crucial in the current market. Leasing may offer lower monthly payments, but it doesn’t build equity. Buying involves higher upfront costs but results in ownership.

Carefully consider your personal financial situation and long-term goals to determine which option is best for you.

By analyzing market trends, understanding manufacturer motivations, and carefully calculating costs, you can effectively use current market conditions to your advantage. This knowledge will empower you to navigate the leasing process confidently and make informed decisions that fit your budget and driving needs.

The Terms That Matter Most in Your Lease Agreement

Negotiating a car lease effectively goes beyond just the monthly payment. Several key terms within your agreement can significantly impact your overall cost and driving experience. Understanding these terms and which are negotiable is essential for securing the best deal.

Key Lease Terms and Their Importance

Beyond the sticker price and monthly payment, several negotiable components deserve close attention. This includes the money factor, essentially the interest rate on your lease. A lower money factor directly translates to lower monthly payments. Additionally, the capitalized cost represents the total amount being financed. Reducing this minimizes your overall lease expense.

The residual value is the projected value of the car at the end of the lease term. This value is crucial for calculating both monthly payments and potential buyout prices.

Negotiable vs. Non-Negotiable Terms

Many lease terms are open for negotiation, but some are typically fixed. Understanding this distinction is crucial for effective bargaining.

To illustrate these key differences, let’s take a look at the following table:

Key Lease Terms Comparison: A comparison of negotiable vs. non-negotiable lease terms and their impact on total cost.

| Lease Term | Negotiable | Typical Range | Impact on Cost | Negotiation Strategy |

|---|---|---|---|---|

| Capitalized Cost | Yes | Varies based on MSRP and dealer fees | Higher cost = Higher monthly payments | Negotiate down the selling price and minimize add-on fees |

| Money Factor | Sometimes | 0.0010 – 0.0030 or higher | Higher factor = Higher monthly payments | Research average rates and negotiate for the lowest possible factor |

| Mileage Allowance | Yes | 10,000 – 15,000 miles per year | Higher allowance = Slightly higher monthly payment, but avoids overage charges | Assess your driving needs and negotiate a suitable allowance upfront |

| Residual Value | Rarely | Set by the leasing company | Higher value = Lower monthly payments | While difficult to negotiate directly, understanding its impact is crucial |

| Lease Term Length | Sometimes | 24, 36, or 48 months | Longer term = Lower monthly payments but higher total interest paid | Choose a term that balances affordability with your desired ownership timeframe |

This table summarizes the key negotiable and non-negotiable terms in a typical car lease. Negotiating the capitalized cost, money factor, and mileage allowance can significantly reduce your total lease cost. Understanding the less flexible terms like residual value and lease term length helps you make informed decisions.

Mileage Allowances and Their Impact

Another important negotiable term is the mileage allowance. This is the maximum number of miles you can drive annually without incurring extra charges.

If you anticipate exceeding the standard allowance, negotiating a higher limit upfront can save you significant costs at the end of your lease. Negotiating a higher mileage allowance might slightly increase your monthly payment. However, this increase is often far less than the penalties for exceeding the limit.

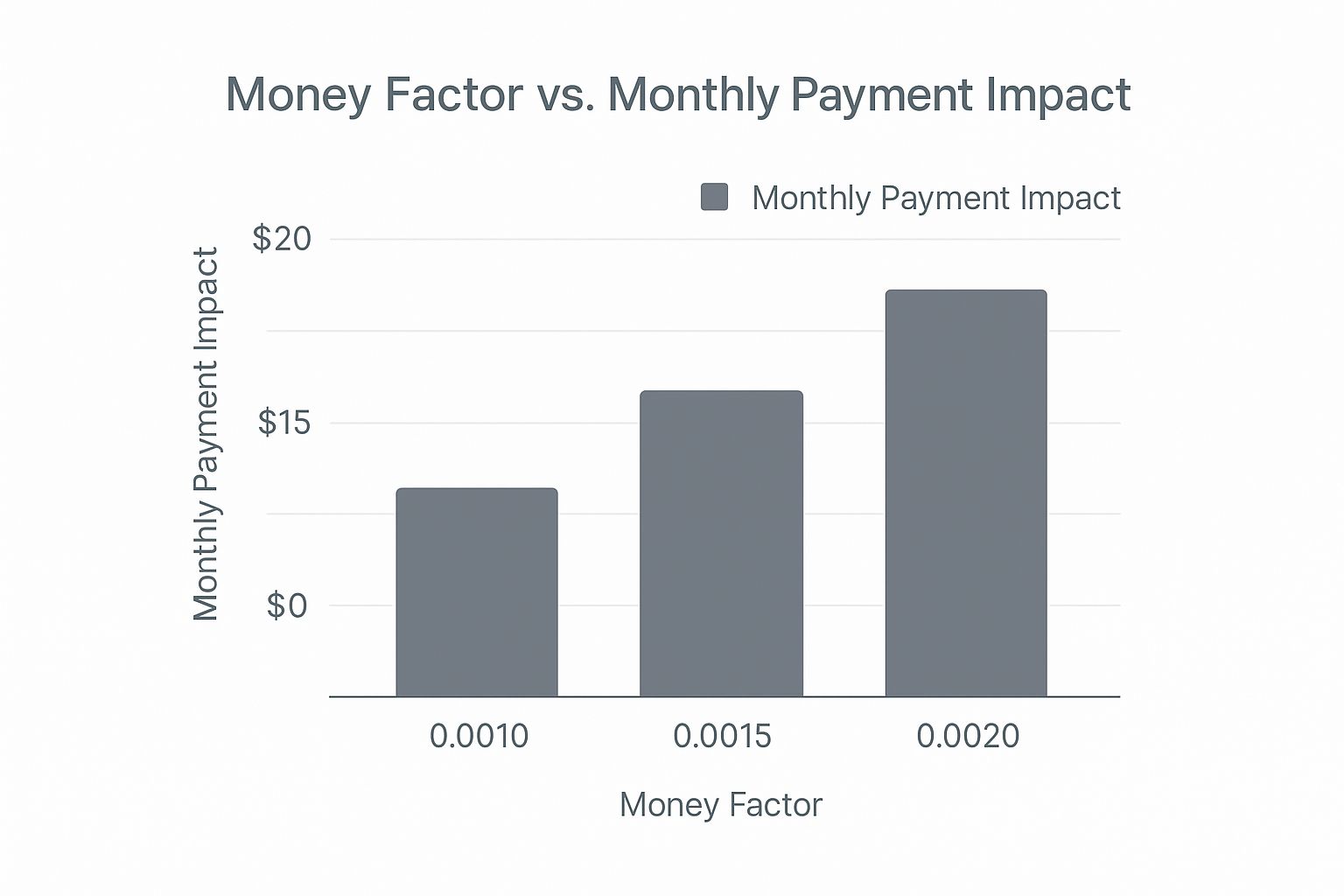

As this infographic demonstrates, a seemingly small difference in the money factor, such as a change from 0.0010 to 0.0020, can lead to a substantial increase in monthly payments. This underscores the importance of negotiating the money factor.

Gap Insurance and Add-ons: What to Consider

Dealers may offer various add-ons, such as gap insurance and maintenance packages. Gap insurance covers the difference between the actual cash value of your leased vehicle and the amount you owe on the lease in case of a total loss.

While these add-ons can offer benefits, it’s essential to carefully evaluate their value and cost. Sometimes, you can find better deals on these services outside of the dealership.

By understanding and strategically negotiating these key lease terms, you can minimize your overall cost and maximize your driving experience. This prepares you to confidently approach the negotiation process, ensuring a lease agreement that suits your needs and budget. Remember, informed negotiation is your key to a successful car lease.

Negotiation Tactics That Actually Work in Dealerships

Successfully negotiating a car lease isn’t about aggressive arguments. It’s about careful planning, subtle skills, and a well-thought-out strategy. This section will provide you with proven negotiation tactics used by experts to secure better lease terms. These go beyond the basics and explore the finer points of effective deal-making.

The Power of Anchoring and Walking Away

Anchoring means establishing a starting point that benefits you. For example, if you know the market value of the car, begin your offer significantly lower. This sets a lower baseline for the discussion. It doesn’t guarantee you’ll get that price, but it creates a more advantageous starting point.

Knowing when to walk away strengthens your position. Dealerships sometimes pressure buyers with a sense of urgency. Don’t fall for it. If the terms aren’t acceptable, be prepared to leave. This often leads to better offers.

Reading Dealer Body Language and Verbal Cues

Negotiation is about more than just numbers. Pay attention to the dealer’s body language and what they say. This can offer valuable insights into their flexibility. Are they hesitant when discussing certain terms? Do they avoid eye contact? These small cues can reveal potential compromise areas.

For instance, a dealer quickly dismissing your initial offer may have more room to negotiate than one who explains in detail why it’s impossible. Pay close attention to their responses. They are often revealing.

Step-by-Step Negotiation Frameworks for Better Deals

A structured negotiation framework can significantly improve your outcome. This could involve focusing on one term at a time or using a “good cop/bad cop” strategy if you have a partner. One person could express price concerns, while the other focuses on the vehicle’s features.

Begin by addressing the capitalized cost of the vehicle. After agreeing on a price, discuss the money factor. This methodical process ensures you don’t lose sight of your overall objective.

Essential Preparation Techniques and Documentation

Preparation is key to successful negotiation. Thorough research on the car’s market value, competitor pricing, and current incentives is crucial. Document everything. This information will be your strongest tool.

Bring printouts of competing offers or online listings showing lower prices. This demonstrates you’ve done your homework. Having tangible evidence reinforces your position.

Handling Multiple Offers and Maintaining Leverage

If you’re considering multiple cars or dealerships, use this to your advantage. Let each dealer know you have other options. This creates competition and encourages better offers. Be genuine; true interest in multiple vehicles provides real leverage.

Throughout the process, maintain your leverage by being willing to walk away. Remind the dealer you’re not obligated to lease from them. This keeps the pressure on and encourages concessions. By mastering these tactics and preparing thoroughly, you’ll be well-equipped to secure the best possible lease terms.

Spotting Traps and Hidden Costs Before You Sign

Negotiating a good car lease goes beyond just getting a low monthly payment. Hidden costs and tricky dealer tactics can quickly increase the total cost if you’re not careful. This section exposes common traps and gives you strategies to navigate the process effectively, ensuring you get the best possible lease deal.

Recognizing High-Pressure Sales Tactics

Dealers often use tactics meant to rush your decision. These might include limited-time offers or downplaying important terms in the contract. Recognizing these tactics is crucial. For example, a dealer might emphasize a low monthly payment while hiding a high money factor or excessive fees. Don’t let pressure sway you; take your time to review every part of the agreement.

This careful review will prevent costly surprises later.

Decoding Legitimate vs. Inflated Fees

Not all fees are the same. Some, like acquisition fees, are standard. Others, like excessive documentation or dealer prep fees, are often just ways to increase profit. Knowing which fees are negotiable and which are usually fixed is key.

For example, while the acquisition fee is usually non-negotiable, documentation fees can often be negotiated. Questioning each fee can significantly lower your overall cost.

End-of-Lease Charges: Avoiding Unexpected Expenses

Many lessees are surprised by end-of-lease charges. These can include excessive wear-and-tear fees, disposition fees, or mileage overage charges. Carefully inspect the vehicle before returning it, documenting any existing damage to avoid disputes.

Accurately estimating your mileage needs when you negotiate your lease can prevent significant overage charges. Understanding these potential costs upfront helps you budget effectively. You might be interested in: What is the Best Option at the End of a Car Lease?

Evaluating Add-ons and Their True Value

Dealers often push add-ons like gap insurance, extended warranties, and maintenance packages. While some can be helpful, it’s essential to evaluate their real value. You can often find similar coverage for less from independent providers.

Comparing prices for these services can lead to substantial savings, allowing you to protect your investment without overpaying. This empowers you to make decisions based on value, not sales pressure.

Pre-Signing Checklist and Red Flags

Before signing any lease agreement, check it carefully for red flags. These could be anything from differences between what you agreed upon and what’s in the contract, to hidden fees not discussed earlier, or very high mileage overage charges.

A pre-signing checklist can be helpful to ensure you haven’t missed anything important. This thorough review can save you from expensive mistakes and guarantee the agreement reflects your negotiated terms.

To help you understand potential hidden fees, take a look at the table below:

Hidden Lease Costs Breakdown: Analysis of common hidden fees and charges in car lease agreements with avoidance strategies

| Fee Type | Typical Cost | Negotiable | How to Avoid | Red Flags |

|---|---|---|---|---|

| Acquisition Fee | $500-$1000 | No | Research average fees in your area | Significantly higher than average fees |

| Documentation Fee | $100-$500 | Sometimes | Negotiate; compare with other dealerships | Excessively high fee; vague description of services |

| Dealer Prep Fee | $200-$500 | Sometimes | Question the necessity; negotiate | High fee for basic services |

| Disposition Fee | $300-$500 | Sometimes | Check lease terms; negotiate | Not disclosed upfront; significantly higher than average |

| Wear-and-Tear Fee | Variable | No | Maintain the vehicle well | Excessive charges for minor wear and tear |

| Mileage Overage Fee | Variable | No | Estimate mileage needs accurately | Extremely high per-mile charge |

This table highlights common hidden fees in car leases, their typical costs, whether they are negotiable, and strategies for minimizing or avoiding them. Pay close attention to the red flags to avoid being overcharged.

Key takeaways: By being informed, recognizing dealer tactics, and carefully reviewing your lease agreement, you can avoid hidden costs and secure a truly favorable lease. This proactive approach puts you in control and allows you to negotiate a deal that fits your budget and driving needs.

Ready for a hassle-free, transparent car leasing experience? Visit VIP Auto Lease today and explore a wide selection of vehicles with competitive lease terms. Let our dedicated leasing specialists help you find the perfect car for your lifestyle.